Group Health Insurance

Group health insurance is a popular choice for employers in all industries. At Narrows Insurance, we help companies of all sizes and industries obtain the proper group health coverage they need to ensure that employees and their families are covered during a time of need. Due to the outrageous cost of hospital bills, a single health accident could cost tens of thousands of dollars or more. For most people this would cause an extreme financial burden for years to come. Because of this, it is important to have health insurance to help mitigate some of the financial damage that can come with health issues. Narrows Insurance recognizes the importance of health insurance which is why we have a dedicated benefits department, always here to help you when you need it.

What is Group Health Insurance?

Group health insurance is a form of coverage that extends to a collective group of individuals under a single insurance policy. Typically provided by employers, this insurance serves as a valuable employee benefit, contributing significantly to efforts aimed at retaining talented workforce. By offering group health insurance, employers not only enhance the overall employee benefits package but also demonstrate a commitment to the wellbeing of their team. This type of insurance provides a shared pool of coverage, often resulting in more cost-effective and comprehensive healthcare options for individuals within the group.

Why Offer Group Health Insurance for Your Business?

Cost

Group health insurance premiums are generally more cost-effective than individual plans, due to the risk being distributed across the entire employee group.

Employee Retention

Securing top talent is essential, and retaining them is even more critical. Offering benefits that prioritize employee well-being serves as a significant incentive for them to remain committed to your company. By providing group health insurance, you not only demonstrate genuine concern for their health but also express appreciation for their valuable contributions.

Streamlined enrollment

Streamlining the insurance process with a unified plan for all employees can save time and alleviate stress.

Healthy Staff

Healthy and well-cared-for team members are inclined to deliver high-quality work. This presents an opportunity to offer crucial services, including preventive care and check-ups, at a more affordable cost.

Does Every Employee Need to be on the Plan?

Opting for a group health insurance plan mandates offering it to all eligible employees based on criteria you establish. For most plans, in order to be eligible you may have to work a specified number of hours per week, such as 40 hours, or complete a probationary period. An example of a probationary period is new employees must wait 90 days to enroll with the company's plan. Typically, employer group plans require a minimum participation threshold, ensuring a certain number of employees enroll in the plan.

Do Businesses Have to Offer Health Insurance to Their Employees?

Small businesses with fewer than 50 employees are not obligated to provide health insurance. However, the Affordable Care Act (ACA) mandates that companies with 50 or more employees offer a group health insurance plan to eligible employees. To fulfill this obligation, a Minimum Essential Coverage (MEC) plan can be provided. A Minimum Essential Coverage plan is one that satisfies all of the requirements imposed by the Affordable Care Act. It's important to note that carriers may have varying minimum group size requirements, meaning the size of your group plan may restrict the carriers available. Fortunately, Narrows Insurance has multiple options for group plans of all sizes to accommodate for this.

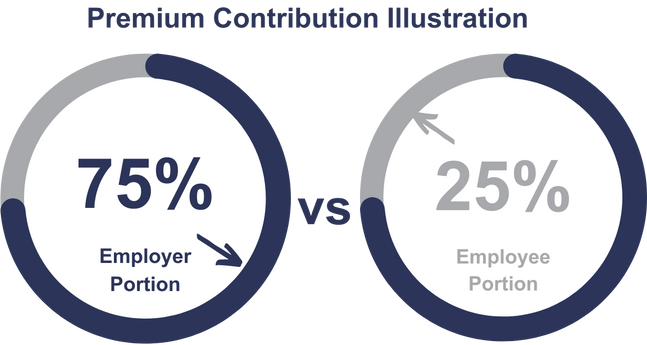

Who Pays the Premium?

Employers and employees both contribute to the premium. Insurance carriers establishing a minimum amount required from the employer. This minimum contribution varies from one carrier to another.

For example:

Let's say an employee's cost of insurance is $400 in total, and the employer contributes 75% of the premium cost.

Employers Pay: 75% of premiums ($300)

Employees Pay: 25% of premiums ($100)

Once the carrier-set minimum contribution requirement is satisfied, you have the flexibility to determine additional contributions, whether by a percentage or a flat dollar amount.

Why Choose Narrows Insurance?

Local

As a locally owned and operated business, we are dedicated to fostering local relationships and actively supporting our community.

Choice

Our independence empowers us to provide a diverse array of options from multiple companies, ensuring we can tailor solutions that best meet your needs.

Partnerships

With over two decades of experience, we have established robust connections with leading national and regional insurance companies.

Expert Advise

We prioritize the education of both our staff and clients, aiming to empower and guide you in making the most informed decisions.

Cost Savings

We specialize in securing better insurance deals by diligently comparing rates from multiple insurance companies on your behalf.

Ease of doing Business

We are committed to leveraging technology and conducting business in a manner that aligns with your preferences and needs.

Employee Benefit Resources We Offer:

- Carrier Negotiations

- ACA Compliance

- Employee Notice Forms

- Annual Plan Reviews

- Cost-Sharing Strategies

- Self-Funded Options

- Employee Handbooks

- Online Enrollment Platforms for employees

- HR Online Platform/Library

Our Partner Companies:

We work with over 50 insurance companies including National companies, Regional companies, Trusts, and more!

Informational statements regarding insurance coverage are for general description purposes only. These statements do not amend, modify or supplement any insurance policy. Consult the actual policy or your agent for details regarding terms, conditions, coverage, exclusions, products, services and programs which may be available to you. Your eligibility for particular products and services is subject to the final determination of underwriting qualifications and acceptance by the insurance underwriting company providing such products or services. This website does not make any representations that coverage does or does not exist for any particular claim or loss, or type of claim or loss, under any policy. Whether coverage exists or does not exist for any particular claim or loss under any policy depends on the facts and circumstances involved in the claim or loss and all applicable policy wording.