Horse Insurance for First Time Owners

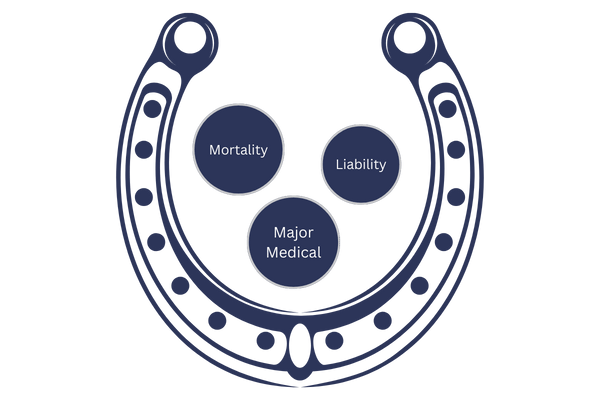

If you recently purchased a new horse, you are probably aware that horse ownership is a large financial investment. One thing that must be considered with equine ownership is insurance. Without insurance, you can end up paying a fortune for veterinary bills and other expenses that you may incur from owning a horse. In this post, we will take a look at the most crucial insurance coverages to look into if you own a horse.

There are multiple types of equine insurance. The age and use of your animal are important factors when determining what kind of coverage you need. In this post, we will discuss the more basic forms of equine insurance for someone just getting into horse ownership.

Equine Liability

The first type of coverage that owners should consider is equine liability. This type of insurance protects you from financial burdens that may arise from your equine injuring someone else or damaging someone else’s property. While this may not seem like a common occurrence, it happens more often than you might think. When owning a horse, you need to not only think about the health of your animal, but the health of others that will be around your animal. Let’s look at a few examples of when this type of coverage may be utilized.

Example 1: Your horse gets loose and is running down the side of a busy road. While your horse is on the run, a car swerves to avoid hitting it and the car ends up in the ditch on the side of the road. While the driver is fine, their car is damaged and needs repairs. Fortunately, your equine liability insurance will pay for the cost of the repairs to the vehicle.

Example 2: You have your animal stabled at a local barn. One of the employees goes in to clean the stable and your horse injures the employee by kicking them. The employee suffers a broken femur. Your equine liability insurance would cover the cost of damages and medical bills for the employee.

Example 3: You have your horse boarded at a training facility. While there, he gets bored and begins to chew on the wooden fence. Afterwards, the fence needs to be repaired which will cost a few hundred dollars in materials and labor to fix. The training facility wants you to pay for it because your equine caused the damage. In this scenario, your liability insurance will cover the cost of the repairs.

This type of coverage also covers costs associated with a lawsuit if someone sues you. Equine liability insurance is typically inexpensive, with options starting around $230 a year. Prices go up depending on the number of horses that are insured. For the cost, it is a very important coverage to have for equine owners. Hopefully, you will never need to use it, but, in the instance that you do it will save you a lot of money.

Major Medical

Another good type of equine insurance you should consider is major medical coverage. This type of coverage is very similar to health insurance, but for your horse. If your horse is injured or gets sick, your insurance will help cover the cost of veterinary bills. These types of bills can quickly add up to thousands of dollars. Without major medical coverage, you will have to pay out of pocket for these expenses.

Insurance companies normally have age restrictions on eligible equines. The age limit is generally 20 years old for most carriers. The older your animal is, the more difficulty you will have finding coverage for it. Similar to obtaining life insurance for humans, some insurance companies ask for proof that your animal is healthy prior to insuring it, and may require a wellness exam.

Having major medical insurance on your equine can give you peace of mind when making difficult decisions. For example, let’s say your horse gets sick or injured and needs a surgery that costs $15,000 and the vet is not sure if the horse will survive the surgery. Without major medical insurance, you would have to pay out of pocket for all of it. This is likely going to heavily influence your decision if you are going to attempt the surgery or put the animal down.

In this same scenario, if you have the proper insurance coverage you would definitely opt for having the surgery since it is not coming directly out of your pocket. For this reason alone, all equine owners should consider major medical so that their decisions align with the benefit of the animal and not the financial impact.

Horse Mortality

Equine mortality insurance is essentially a life insurance policy for your equine. It pays a death benefit if your horse passes away due to an accident, injury, disease, or illness. This type of coverage is usually dependent on what you use your horse for and what it is worth. If your horse has a high value or you use it for work, a mortality policy may be a option for you.

People who use their horses for work often choose a mortality policy because it can impact their income if one of their horses dies. If the animal is still alive and unable to perform its intended use, you can still receive a benefit through a Loss of Use policy. This is sometimes offered as a standalone policy by insurance carriers, or more commonly, an endorsement to an existing policy. Be sure to ask your agent about this when inquiring for equine insurance.

Summary

Horse ownership is a rewarding, albeit expensive, venture. Ranging from thousands to hundreds of thousands of dollars, horses are large financial investments that should be protected accordingly. Equine insurance is a cost-effective way of protecting your investment, and protecting your animals. The proper equine coverages can help cover the costs of keeping your animal healthy, offer financial protection from damages that your animal may cause, and insure the life of your horse. Whether you are purchasing your first horse or your tenth, we can help you obtain the coverage you need and answer any questions you might have. Contact Narrows Insurance today for a quote!